Are you a small-and-medium-sized enterprise that needs funds for your commercial activities? If so, then Malaysia’s top banks and development financial institutions have what it takes to increase net working capital.

With an SME loan from one of these reliable sources, customize your business finance plan today in order to improve credit ratings with on-time low-interest repayments!

What is SME?

SME is an acronym for small and medium-sized enterprises. In Malaysia, an SME is defined as a company with full-time employees not exceeding 200 and with paid-up capital below RM50 million or annual sales turnover not exceeding RM250 million.

The SME Development Division of the Ministry of International Trade and Industry (MITI) is responsible for formulating and coordinating policies and initiatives to develop SMEs, In Malaysia.

In order to qualify as an SME, your business needs two things: sales turnover and the number of full-time employees.

This will depend on what sector you are in economically; there are different criteria for each one!

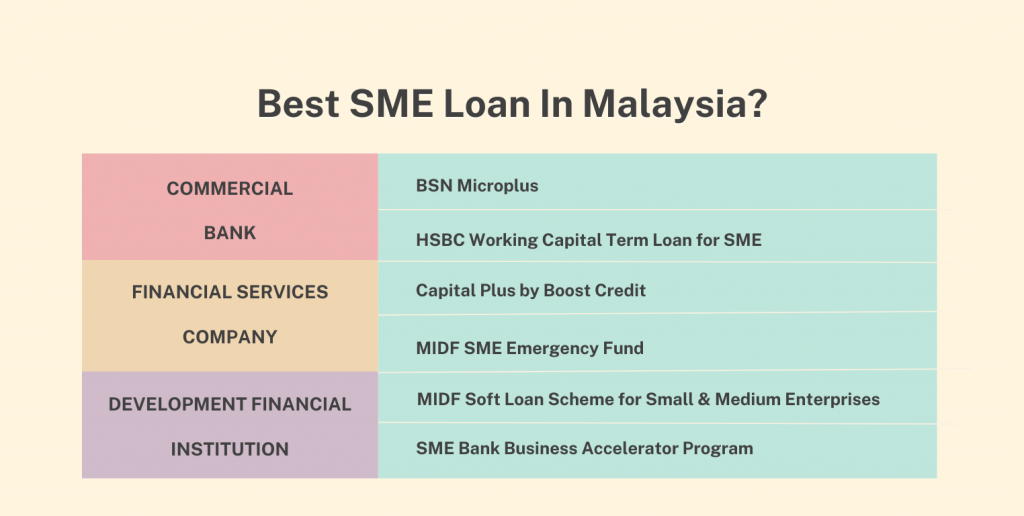

Best SME Loan In Malaysia?

Does SME matter in Malaysia?

SMEs are the backbone of the Malaysian economy, accounting for 99% of total business establishments and employing 58% of the country’s workforce. In 2016, SMEs contributed to 38.5% of Malaysia’s GDP.

In 2019, the Malaysian government introduced the SME Masterplan to increase the contribution of SMEs to GDP to 41% by 2025. The masterplan has 4 pillars:

- Strengthening the SME ecosystem

- Enhancing competitiveness

- Accelerating growth

- Creating a conducive environment for SMEs

The government has also set up various initiatives to support SMEs, such as the SME Development Fund, the eRezeki, and eUsahawan Programme, the SME Loan Guarantee Scheme, and the SME Working Capital Guarantee Scheme.

What Are The Challenges Faced By SMEs In Malaysia?

The most common challenge faced by SMEs is access to financing. This is because banks and financial institutions tend to be more risk-averse when lending to SMEs, as they are considered high-risk investments.

Other challenges faced by SMEs in Malaysia include:

- Lack of skilled workers

- Red tape and bureaucracy

- Lack of awareness of government assistance programs

- High cost of compliance

- Lack of access to finance and capital

Why Should You Consider an SME Loan?

There are many reasons why you should consider an SME loan, such as:

1) To start up your business:

2) To expand your business:

3) To buy new equipment:

4) To improve your cash flow:

5) To consolidate debt:

Conclusion

About Limra Assets

Limra Assets is a Shariah-compliant financing solutions financier that provides loans for property financing, SME businesses loans and gold investment. We offer a range of financing options to help individuals and businesses, including alternative financing for businesses that are unable to obtain funds. Our goal is to provide access to funds for investments in a Shariah-compliant manner that focuses on transparency, customer service, and competitive rates, Limra Assets can be a valuable partner in your gold investment journey.

If you’re interested in learning more about Limra Assets and our Shariah-compliant financing solutions for property purchases, gold purchases or business loans, please contact us for more information.

Disclaimer:

It is important to note that taking out a loans for any purchases and gold investment, whether through Limra Assets or any other lender, carries risks and should be approached with caution. It is important to carefully consider your financial situation and investment goals before taking out a loans, and to ensure that you fully understand the terms and conditions. Additionally, investing in gold carries its own risks and should be done with the guidance of a financial professional. This information and all external links are provided for educational purposes only and should not be considered financial advice.